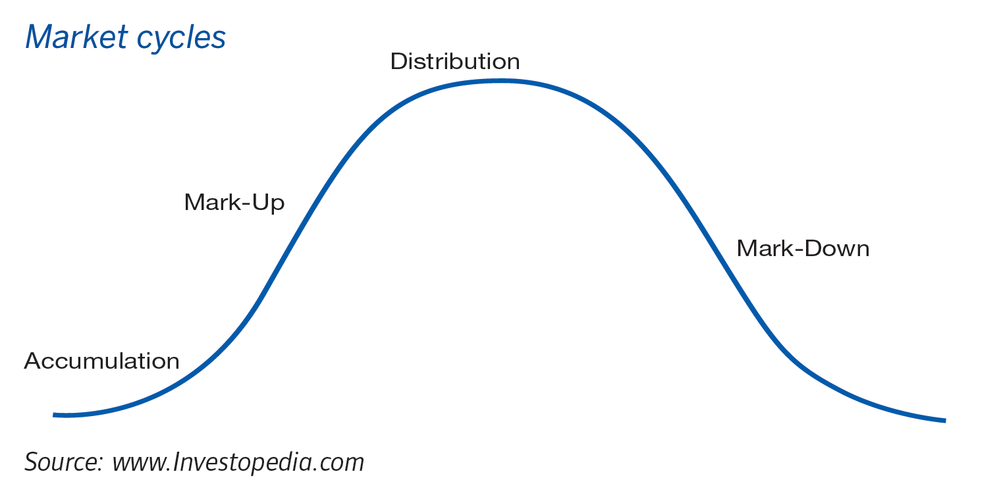

Market cycles

Markets go through different stages – or cycles – even though the long-term trend has been for share prices to appreciate. All markets are cyclical: they increase, peak, fall and then bottom. Market cycles are more important for traders than long-term investors who leave their money in the market for longer than a complete cycle.

Typically, there are four phases in a market cycle.

The first, or accumulation, phase occurs once a stock market has reached the bottom of the last cycle. However, most investors don’t recognise this as the beginning of a new upward cycle so only very astute and experienced investors enter the market at this stage. Though valuations are attractive, market sentiment remains bearish (negative) and then, slowly, turns neutral.

In the mark-up phase, share prices begin to increase as more investors realise that the cycle has turned. During the distribution phase, sellers begin to dominate. The market’s bullish (positive) sentiment becomes mixed and prices can be range-bound. This third phase can be short or long, but it inevitably gives way to the final stage of the cycle.

The mark-down phase is the last stage of the investment cycle. Ironically most die-hard investors, who have held onto their shares as prices crumble, will sell just as the market reaches its bottom.

There are variations within this simplistic framework as investor sentiment can stretch market cycles to extremes such as bull markets, bubbles, crashes, corrections and bear markets.

- In a bull market, positive investor sentiment drives share prices higher – sometimes to beyond what the earnings’ fundamentals can support. At this point the bull market risks becoming a speculative bubble.

Market Corrections

- Corrections are where share prices retrace some of their gains. Typically, share prices will make up their loss quite quickly after a correction.

- A bear market occurs where share prices continue to fall for some time after a correction.

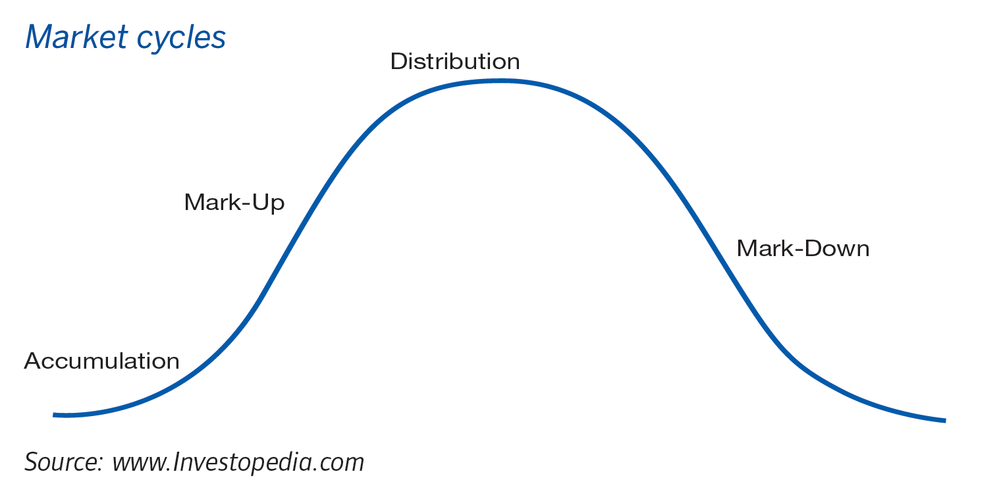

- Over-inflated stock market bubbles may be ended by crashes, where share prices fall sharply in a short period. The good news is that the share prices of the corporate survivors of these crashes do recover. As the chart below shows, it took the JSE 20 months to recover to its pre-cash levels after the 1987 crash.

If you'd like more info on this, you can check out this post: A correction in time

Source: Bloomberg

Source: Bloomberg

More articles on investing: