Welcome to 2019 – we made it this far. We all know that 2018 was a terrible year for investors on the local bourse. The Top40 closed 11.5% down for the year, and some of our large cap stocks ‘saw flames’, as the kids on the internet would say. Of course, trading volumes suffered.

Source: Bloomberg

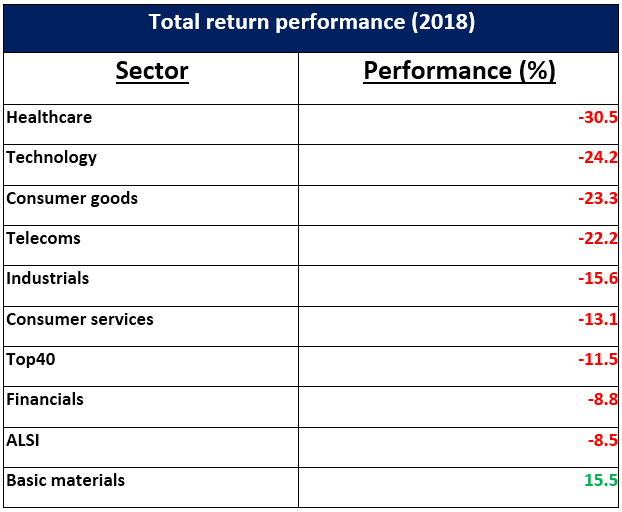

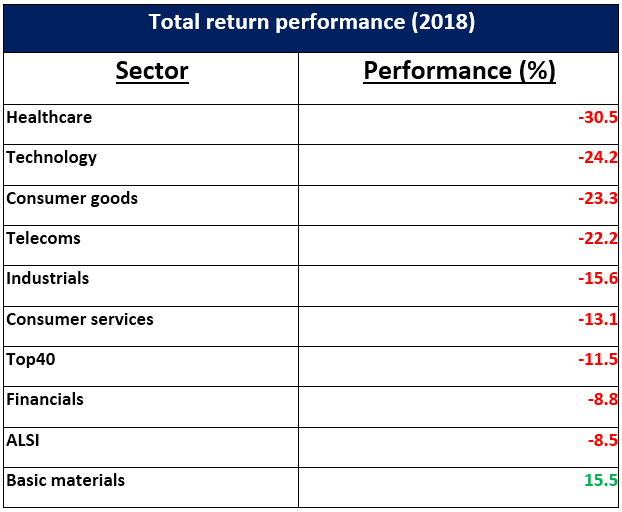

International investors were jittery following the emerging market scare that had people speculating on whether there would be another EM crisis, akin to the one in 2013. It’s not surprising, given that countries like Turkey and Argentina gave investors a compelling reason to check out of the emerging markets. For South Africa, those fears were lumped with an unfavourable market (as pointed out above). Below is a look at total return performance by sector for 2018:

Source: SBG Securities Analysis, Bloomberg

Add the lethargy of small and mid-cap stocks and you understand why people wouldn’t be blamed for taking their money out of the market and parking it in cash then choosing to ‘wait-and-see’. However, this may not be the best move – particularly if you’re playing the long game. It’s important to always bear in mind that when it comes to investing, time is your biggest ally, closely followed by compounding. Both work together to help you create wealth. Compounding cannot work if you don’t give it the time to work. And, by 'time', we mean at least 10 years.

So how does one navigate a bear market without putting all your funds in cash and waiting the slug out? We have a few pointers you can use as a basis for your strategic planning:

- Do not put your head in the sand. The worst thing you can do is turn a blind eye to what’s going on.

- Reassess your strategy: it’s the new year and you have a somewhat clean slate to work from. There are a few questions you can use to help you make an informed decision:

- Which companies did badly and why?

- What economic and political factors affected companies with global exposure?

- How do the company fundamentals look?

- What are the prospects of the company and how will technology affect it company in the next 5 to 10 years? It’s important to use this time frame as a yardstick because that’s how far ahead you need to be thinking.

- Align your strategy with your long-term financial goals. It’s tempting to focus on putting out the small (in the greater schemes of market performance in the last 100 years) fires – maintaining perspective and focus will help you reach your goals.

- Refresh your knowledge of markets. This is particularly important if you still don’t have a firm grasp of what drives valuations. You don’t have to be a professional portfolio manager, but analysing a company includes looking at external and internal events to get a clearer picture of what’s going on. There are fundamental metrics you can look at – even if you do not have an accounting background. This webinar will help you understand these metrics and why they matter: Financial ratios for Fundamental Analysis: which numbers to look for and why.

- Don’t panic. This is easier said than done, but approach your strategy with as much information as possible to make an informed decision.

You can also take a read at this very insightful piece from Bloomberg. While it’s geared towards US investors, the underlying principles are the same: What to expect when you’re expecting a bear market.

This material is considered educational communication and does not constitute advice. Please read our disclaimers here.